I like to discuss the randomness of the world and just talk about nothing in particular

Sunday, June 5, 2011

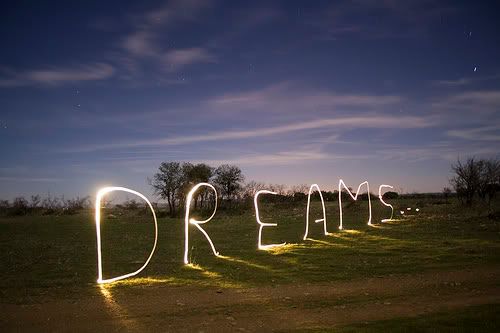

...Dreams...

Well I don't know if everyone might feel the same way about dreams as I do, but I believe sometimes that in our dream state that our subconcious tries to tell us stuff from time to time.

One time about 3-5 years ago, I had one of these dreams that still makes me wonder to this day, if something / someone was trying to tell me something or not. At the time I just finished vocational school, and I was unemployed about 4 months in a row trying to find a job, and me and my Fiance at the time were stuggling to survive.

I was dreaming at the time that Me, her and my parents were driving to the river in our local time to go on a boat ride, and I was really excited, but this gravel road was long and narrow, and along the way I was seeing some that made me go WTF..!! OMgZ...!!!!!11!!1! Well there were people all over the place, standing around fire barrels and such, and they were people from lawyer looking people talking on cell phones, to poor homeless people trying to stay warm and by these people on this road were white painted door frames, with closed doors and when we were driving by one person quickly ran in the door and there was this pure goldish/white light

Then I woke up and I felt like there wasn't any issues, like I was on top of the world and just had this feeling of pride or satisfaction. I was wondering if subconciously I was telling myself that there were many paths in life and that you just have to pick were you go, then suddenly like a week later I got a job, yeah it wasn't the type of job that I wanted and still work there, but there is some sort of satisfaction knowing that this place is stable as long as you atleast try.

Wednesday, June 1, 2011

Well another increase in Taxes..

Get ready for higher Social Security taxes!

They will go up by 2%, from 4.5% this year to 6.2% next year. But that’s only for people who work for an employer. For self-employed Americans, the bite will be double.

As explained by Bill Bischoff of SmartMoney.com, May 27, 2011:

For 2011, the Social Security tax hit is less because of a one-year 2% point reduction in the Social Security tax withholding rate on wages — from the normal 6.2% to 4.2% (your employer’s 6.2% rate is unchanged). For 2012 and beyond, however, Social Security tax withholding on your wages will jump back to the standard 6.2% rate.

If you’re an employee, your wages are hit with the 12.4% Social Security tax up to the annual wage ceiling. Half the Social Security tax bill is withheld from your paychecks. The other half is paid by your employer. That arrangement is very deceptive because unless you closely examine your pay stubs, you may be blissfully unaware of how much the Social Security tax actually costs because your employer isn’t really paying your Social Security tax. Your employer’s “share” of your Social Security tax is actually part of your entire pay-and-benefits salary package.

While many employees may not realize the magnitude of the Social Security tax, self-employed folks know it all too well. That’s because the self-employed must pay the entire 12.4% tax rate out of their own pockets, based on the amount of their net self-employment income.

For both 2010 and 2011, the Social Security tax self-employment income ceiling is $106,800 (same as the wage ceiling for employees). So if your 2010 self-employment income was $106,800 or more, you paid the Social Security tax maximum of $13,243 last year (12.4% x $106,800 = $13,243).

In 2011, the hit will be less thanks to a one-year 2 percentage-point reduction in the Social Security tax rate on self-employment income — from the normal 12.4% to 10.4%. For 2012 and beyond, however, the Social Security tax on self-employment income is scheduled to return to the standard 12.4% rate.

The SmartMoney.com article’s writer, Bischoff, estimates that in the course of his 35-year working life, he has paid $219,000 in Social Security tax and his employers paid another $41,000. That amounts to $260,000 in total.

Bischoff writes: “if I could get the $260,000 back, stop paying the tax, and forego receiving any benefits, I would do it in a heartbeat. In fact, if I could just stop paying the tax in exchange for walking away from any future benefits, I would do that too. Why? Because I have big doubts I will actually receive the promised level of benefits when the time comes…the system is now projected to run out of money in 2036 unless taxes are raised or benefits are cut.”

I have bad news for Bischoff:

I have bad news for Bischoff:

The Social Security system is already broke.

In January this year, the Congressional Budget Office issued a little-noticed report that Social Security will effectively run a $45-billion deficit in 2011 and continue to run deficits totaling $547 billion over the coming decade.

For both 2010 and 2011, the Social Security tax self-employment income ceiling is $106,800 (same as the wage ceiling for employees). So if your 2010 self-employment income was $106,800 or more, you paid the Social Security tax maximum of $13,243 last year (12.4% x $106,800 = $13,243).

In 2011, the hit will be less thanks to a one-year 2 percentage-point reduction in the Social Security tax rate on self-employment income — from the normal 12.4% to 10.4%. For 2012 and beyond, however, the Social Security tax on self-employment income is scheduled to return to the standard 12.4% rate.

The SmartMoney.com article’s writer, Bischoff, estimates that in the course of his 35-year working life, he has paid $219,000 in Social Security tax and his employers paid another $41,000. That amounts to $260,000 in total.

Bischoff writes: “if I could get the $260,000 back, stop paying the tax, and forego receiving any benefits, I would do it in a heartbeat. In fact, if I could just stop paying the tax in exchange for walking away from any future benefits, I would do that too. Why? Because I have big doubts I will actually receive the promised level of benefits when the time comes…the system is now projected to run out of money in 2036 unless taxes are raised or benefits are cut.”

I have bad news for Bischoff:

I have bad news for Bischoff:The Social Security system is already broke.

In January this year, the Congressional Budget Office issued a little-noticed report that Social Security will effectively run a $45-billion deficit in 2011 and continue to run deficits totaling $547 billion over the coming decade.

Subscribe to:

Posts (Atom)